Amalgamations – Section 87

Amalgamations – Section 87

General

- Section 87 rollover is used when an amalgamation takes place

- Amalgamation is when two or more corporations merge and form a new corporation

- With Section 87, the two corporations can transfer their assets to the new corporation tax free

Criteria for Section 87 Tax Free Rollover

- The predecessor corporations must be taxable Canadian corporations

- All of the shareholders of the predecessor corporations must receive shares of the new amalgamated corporations

- The Shareholders must only receive shares in the amalgamated corporation (no other considerations are allowed)

- The original shares held by the shareholders of the predecessor corporation must be held to earn capital gains rather than business income

- All assets and liabilities of the predecessor corporations (other than intercompany balances) must be transferred to the new amalgamated corporation

The Effect of the Rollover

All assets of the predecessor corporation will be transferred at tax value; such that no income, capital gains and recaptures are triggered

| Asset | Rolled over @ |

| Inventory | Cost |

| Depreciable Capital Property | UCC |

| Non-Depreciable Capital Property | ACB |

| Eligible Capital Property | 4/3 * Cumulative Eligible Capital Balance |

Tax Balances and effect of Section 87 Rollover

| Balance | Effect of Rollover |

| Non-Capital Losses | Flowed through to amalgamated co. |

| Net-Capital Losses | Flowed through to amalgamated co. |

| Capital Dividend Account (CDA) | Flowed through to amalgamated co. |

| GRIP | Flowed through to amalgamated co. |

| LRIP | Flowed through to amalgamated co. |

| Refundable Dividend Tax on Hand (RDTOH) | Flowed through to amalgamated co. |

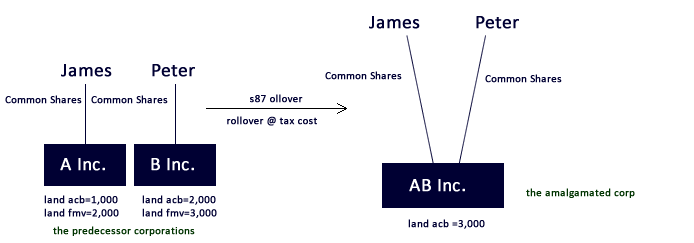

Example of Amalgamation and Section 87 Rollover

Example

- Suppose A and B are predecessor corporations; the only asset they own is land

- They merge to form AB

Vertical Amalgamation

• A vertical amalgamation occurs when a parent and a subsidiary merge

• Different ways of structuring a vertical amalgamation tax-free

1. Using Section 87

• Section 87 can be used anytime a parent and a sub are merging

• Under Section 87, the parent does not need to own 90% or more of the shares of the sub

2. Using Section 88 (see notes)

• Section 88 can only be used when a parent and a sub are merging, and when the parent owns 90% or more of the shares of the Sub

• A very similar result to Section 87

Vertical Amalgamation using Section 87 and Bump-up Rule

The Bump-up is only allowed under Section 87 if the parent owns 100% of the shares of the subsidiary

What is the bump-up?

- When the parent initially purchased the sub, it likely paid a price greater than the tax values sub’s net assets

- The money the parent used to buy the sub is obviously after tax money

- When the parent and sub merge, the net assets will get transferred at the tax values; however, this isn’t fair because the parent may have paid a higher price, and the price it paid was with after tax money

- To make up for this, the CRA, allows you to bump up the adjusted cost base (ACB)of non-depreciable capital properties that the sub continuously owned since the parent acquired control

Bump-up Formula:

The Bump-up of the ACB of the depreciable capital properties mentioned above is the lesser of:

- ACB of the Sub’s shares – the tax values of Net Asset of Sub on date of amalgamation – dividends paid by sub to parent (including capital dividends); and

- FMV of the Sub’s non-depreciable property – ACB of Sub’s non-depreciable property at the time the parent acquired control of the sub

Example of the bump-up rule:

- Parent co. purchased 100% of the shares of Sub co. on January 1, 2010 for $400,000. The Sub only owned a land and had no liabilities. At the time of acquisition: the ACB of land = 100,000; and the FMV of land= 200,000

- ACB of the Sub’s shares = $400,000

- Dividends paid by Sub to Parent since acquisition= $20,000

- On December 31, 2012, the parent co and the sub co amalgamated

- The tax value of the net assets of the sub = $200,000

- The subsidiary still owns the land

- Without the bump-up the land will transfer @ ACB = $100,000; this is not fair considering that parent paid $200,000 ($400,000-200,000) in excess of the current tax value of net asset. Of this, they recovered $20,000 via dividends, and as a result, they paid a net $180,000 in after-tax money. This is where the bump-up provides some fairness.

- Using the formula above, Bump-up of land is the lesser of

- 400,000-200,000-20000 = $180,000; and

- 200,000 – 100,000 = $100,000

- Therefore, the land can be bumped up by $100,000

- The new ACB of Land = 100,000+100,000 = 200,000

- Note how CRA limited the bump-to ensure that the land does not get restated to a value greater than the FMV at the time parent acquired the sub

- Therefore instead of giving the full 180K bump-up, that represents the net after-tax cost, CRA only gives 100K

Deemed Year End

- For all amalgamations there is a deemed year end one day before the amalgamation for all predecessor corporations

- The new amalgamated corporation begins its taxation year on the day of the amalgamation and it can choose any year end

- Implications of deemed year end

- SBD limit of 500K needs to be prorated

- CCA needs to be prorated

- Non-capital losses age by 1 taxation year (the shortened tax year will count as one carryforward year)

Loss Utilization

- In a vertical amalgamation between a parent and a 100% owned subsidiary:

- Losses realized by the amalgamated corporation (after the amalgamation) can be carried back against the income of the former parent corporation

- Section 87(2.11) – says that in a vertical amalgamation the new corporation is deemed to be a continuation of the predecessor corporations for the purposes of non-CL and net-CL

- For other situations:

- Since non-capital losses and net-capital losses flow through to the amalgamated corporation, it can be carried forward against the income of the amalgamated corp.

Effect on Shareholders

- Provided all the criteria above are met the shareholder is deemed to dispose his shares in the predecessor corporation at ACB and acquire the shares of the new amalgamated corporation at the same ACB