Renting a Principal Residence – Change In Use Rules

Renting a Principal Residence – Change In Use Rules

Case 1: Complete Change in Use

Going from Principal Residence to Income-generating

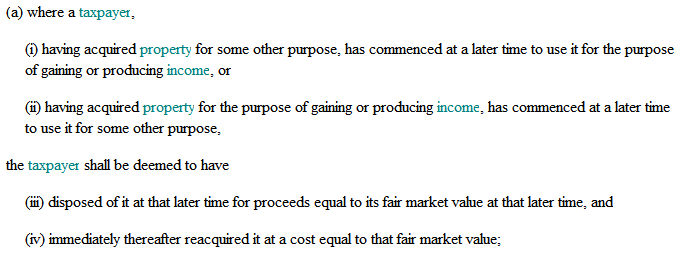

45(1)(a) – Deemed Disposition of Principal Residence

If a taxpayer completely rents out the entire property (i.e. converts the entire property from personal use to income-producing use) per 45(1)(a), the taxpayer is deemed to have disposed and re-acquired both the land and building at fair market value

You can use your principal residence exemption to offset any capital gains generated due to this deemed disposition per 45(1)(a)

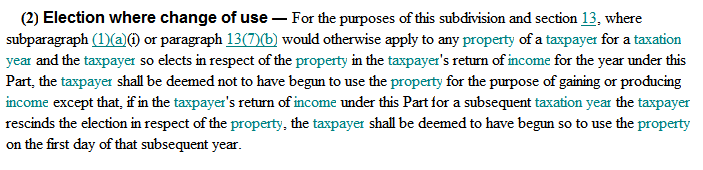

45(2) – Election out of the deemed disposition

You can avoid this deemed disposition by electing under 45(2) – you will be deemed not to have changed the property from “principal residence” to “income generating”

- This election is done by sending a letter attached to the T1 with the taxpayer’s signature to the CRA

- If in a subsequent tax year, you rescind this election, then section 45(1)(a) above will apply and a deemed disposition will take place at that time

- If CCA is claimed on the property, the election is considered to be rescinded on the first day of the year in which that claim is made (therefore a deemed disposition will take place)

- This is important because on rental properties you are allowed to designate a maximum of 4 years for the principal residence exemption, while the property is being rented out (provided you are still a Canadian resident). If you claim CCA, the property will be deemed to be “income generating” rather than a “principal residence” and thus will not be eligible for the principal residence exemption. Therefore, you risk losing some or all of the 4 additional years you get for the principal residence exemption while you rent out the property.

An Example

Lisa owned a home that she purchased in 1999. She lived in this home until June 1, 2002 at which point she rented the house to a friend while she lived elsewhere. The rental period lasted until May 30, 2008. Lisa moved back to her house on June 1, 2008. Lisa then sells the house in 2010 for above cost. Lisa did not claim CCA during the rental period.

When she filed her 2002 T1 return she attached a letter filing for the 45(2) election so that she can use the max 4 years for principal residence exemption.

In 2010, for the principal residence exemption she elects the following years

- From 1999 to 2002: 4 years (she “ordinarily inhabited” the house)

- From 2003 to 2007: 4 years by virtue of 45(2) – note that although this house was rented for 5 years, she can only use a max of 4 years

- From 2008 to 2010: 3 years (she “ordinarily inhabited” the house)

The house was owned for a total 12 years; and with the “1 plus” rule for principal residence exemption – she will be able to offset the entire capital gains with the principal residence exemption i.e. (1+12)/12 * Capital Gain.

If Lisa had claimed CCA during 2003-2006, she will not have been eligible for the principal residence exemption for those years.

Going from Principal Residence to Income-generating

If a taxpayer completely rents out the entire property and later moves back in, per 45(1)(a) there will be a deemed disposition and re-acquisition of both the land and building at the fair market value at the time the taxpayer moves back in.

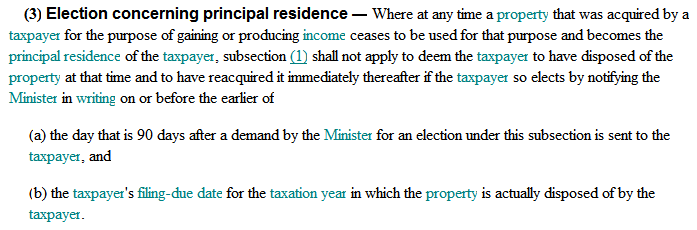

You can avoid this deemed disposition and re-acquisition by electing under 45(3) – by sending a letter to the CRA when the property is ultimately sold

An election under 45(3)is not possible if on or before the change in use of the property from income–producing to a principal residence, CCA has been claimed by the taxpayer or spouse. Potential Capital Gains may arise (no principal residence exemption will be available)

Similar to the 45(2) election, a property can qualify as a taxpayer’s principal residence for up to 4 years prior to a change in use covered by subsection 45(3) election (provided the taxpayer is a Canadian Resident during that time)

Example:

David purchased a home in 2000 and rented it out immediately until 2006. He then moved himself and his family to the home and started living in it since 2006. He sold the property in 2008. He did not claim CCA during the rental period.

In 2006 there will be a deemed disposition and re-acquisition by virtue of 45(1)(a); however by virtue of 45(3), David can avoid the deemed disposition.

In 2008, for the principal residence exemption he elects the following years:

- From 2000 to 2005: 4 years (by virtue of 45(3))

- From 2006 to 2008: 3 Years (he ‘ordinarily occupied’ the home)

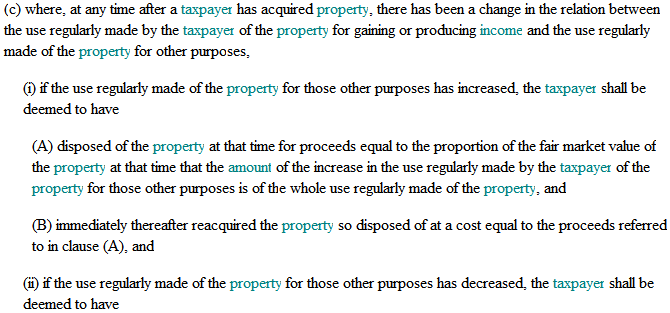

Case 2: Partial Change in Use

- If a taxpayer partially converts his principal residence to an income-generating property, per 45(1)(c) there will be a deemed disposition and re-acquisition for that part of the property at fair market value prorated based on the area involved (i.e. square feet)

- You can use the principal residence to offset the deemed capital gains

- If at a later time, the partial property is changed back from income-generating to a principal residence, there will be another deemed disposition and re-acquisition at fair market value based on the area involved.

- An election under subsection 45(2) or (3) cannot be made where there is a partial change in use of a property as described above.

- The CRA only applies the deemed disposition and re-acquisition under 45(1)(c) only where the partial change in use of the property is substantial and of a more permanent nature, that is, where there is a structural change.

- Examples of significant partial change in use where CRA will consider a deemed disposition under 45(1)(c):

- Conversion of the front half of a house into a store

- The conversion of a portion of a house into a self–contained domestic establishment for earning rental income (a duplex, triplex, etc.)

- Alterations to a house to accommodate separate business premises

- CRA will not consider a deemed disposition where all of the following conditions are met:

- The income–producing use is ancillary (i.e. Minor/insignificant) to the main use of the property as a residence;

- There is no structural change to the property; and

- No CCA is claimed on the property

- Examples where CRA will not consider a deemed disposition in the partial change in use of a principal residence:

- Taxpayer carries on a business of caring for children in the home,

- Rents one or more rooms in the home

- Has an office or other work space in the home which is used in connection with business or employment.

When to claim CCA on the partial property and when not to claim CCA:

- When the partial change in use of the property is substantial and of a more permanent nature, CRA will deem it to be income-generating and there will be a deemed disposition and re-acquisition regardless of if you are taking CCA or not. Therefore, it makes sense to take CCA in this scenario and minimize taxable income.

- When the partial change in use is minor and no structural changes made, DO NOT take CCA! Because if you do, CRA will immediately consider you to have made a change in use and thus a deemed disposition of the partial property, and you will lose your principal residence exemption on that portion of the property. You are free to claim all other expenses like maintenance, utilities, etc…

Key Takeaways for Tax Planning

- If you are renting out the entire home and you take CCA on the property you will not be eligible for the 45(2) and 45(3) elections, and thus you will have two consequences:

- The property will change from Principal residence to income-generating immediately when you start taking CCA. There will be a deemed disposition and potential Capital Gains.

- Because of (1) you will not be eligible for the additional 4 years you can use for the principal residence exemption, while you are renting the property and not ordinarily inhabiting it

- Therefore, if you are considering using the home as a principal residence for some of the years, don’t claim CCA. We advise those just renting out just one property and planning to re-occupy to not claim CCA. Those in the business of renting properties should claim CCA because they likely are not going to use these properties as their principal residence anyways.

- For partial change in use where no structural changes are made to the home (i.e. renting out a basement) Do not take a CCA deduction, or else deemed disposition will take place, the basement will become income-generating, and that portion of the home (i.e. basement) will not be eligible for the principal residence exemption in the future when you sell the home.

- For partial change in use where structural changes are made (i.e. significant partial change in use) claim CCA because there will be a deemed disposition and change in use to income-generating regardless of CCA.