FACTS

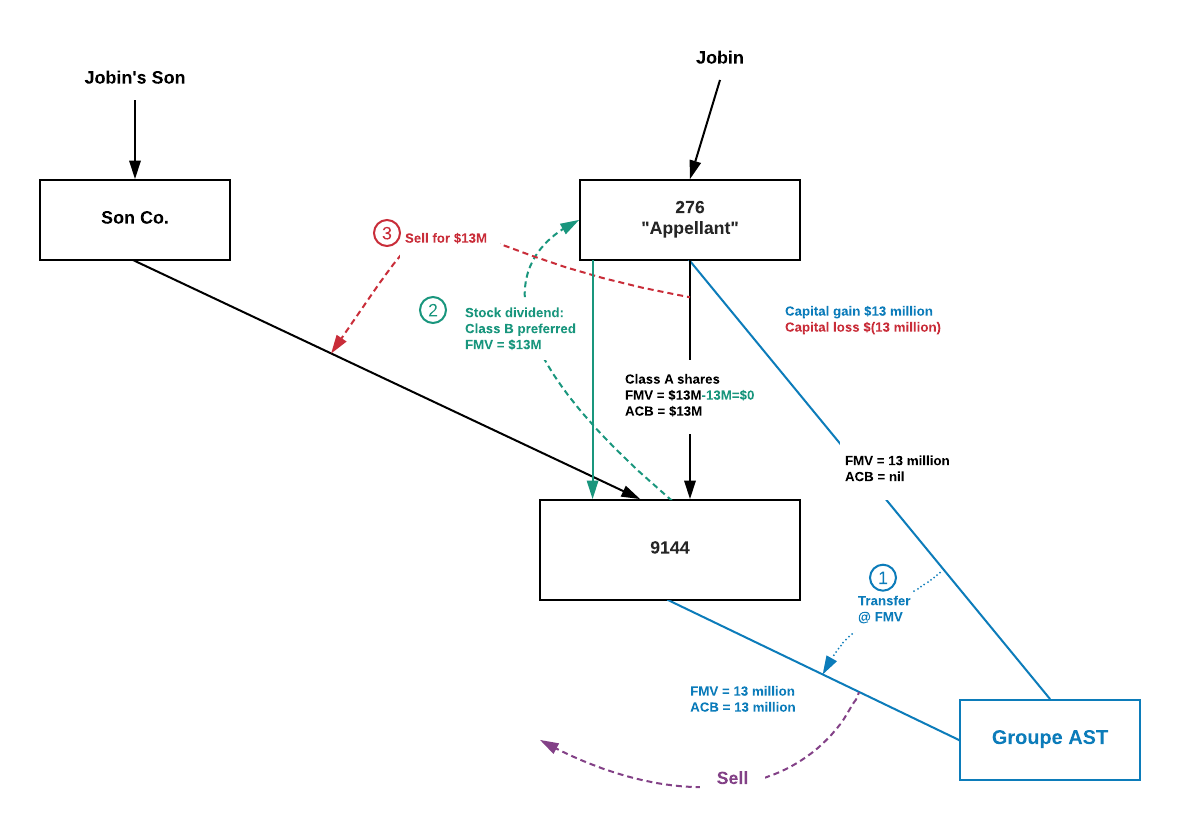

- Jobin owned shares in Groupe AST (assume FMV = $13 million and ACB = $nil). He received an offer for his shares from a third-party purchaser. To minimize his taxes, Jobin undertook the following steps.

- Jobin rolled his shares in Groupe AST – which had a fair market value of $13 million – on a tax-deferred basis to 2763478 Canada Inc. (“276”), also a company wholly-owned by him. No capital gains were triggered in this transfer.

- 276 then sold the shares of Group AST to another wholly-owned company, 9144-4075 Québec Inc. (“9144”), in exchange for Class A shares in 9144. This transfer took place at the full fair market value, triggering a capital gain of $13 million in 276. The Class A shares of 9144 had the following attributes: FMV = $13 million; ACB = $13 million.

- 9144 then sold the shares of Groupe AST to a third-party purchaser for $13 million; no capital gains resulted in this transaction because 9144 had full ACB in the shares of Groupe AST.

- After the sale transaction, Jobin implemented an estate freeze through a stock-dividend to accrue future growth to his son. To accomplish this, 9144 declared a stock dividend on the Class A shares consisting of Class B preferred shares with a fixed redemption value of $13 million.

- The stock dividend shifted value from the Class A shares to Class B preferred shares, leaving the Class A shares with an unrealized capital loss of $13 million (since the Class A shares now had a FMV of $nil and ACB of $13 million).

- 276 then sold the Class A shares of 9144 to a company wholly owned by Jobin’s son for $nominal proceeds and claimed a capital loss of $13 million.

- 276 used the $13 million capital loss to shelter the previously realized $13 million capital gain.

ISSUE

Should the general anti-avoidance rule (GAAR) apply to deny the $13 million capital gain?

Ruling

The Federal Court of Appeal (FCA) unanimously ruled that GAAR should apply for the following reasons:

| Tax Benefit | There was a tax benefit because 276 was able to reduce its taxes by claiming a capital loss. |

| Avoidance Transaction | If any transaction within the series was not undertaken primarily for a bona fide – i.e.: non-tax – purpose, the series will be treated as an avoidance transaction. The series consisted of the following: (i) The FMV sale of Groupe AST shares by 276 to 9144 (ii) The stock dividend by 9144 to 276, and (iii) Sale of the Class A shares of 9144 to Jobin’s son The taxpayer argued that these transactions were not a series and were done for bona fide purposes other than to obtain a tax benefit because the stock dividend and the sale of the Class A shares to 9144 were part of an estate freeze transaction – to have future growth go to Jobin’s son. The FCA disagreed and stated that the estate freeze transactions took place “in relation to” and “because of” the earlier sale. Moreover, the FCA ruled that 276 could have done a simple estate freeze by transferring the Class A shares in exchange for Class B preference shares. It was structured as a “stock dividend” freeze primarily to reduce taxes. |

| Abuse | The FCA held that 276 suffered only a “paper loss”: it was neither richer nor poorer following this transfer. The only change that took place is that rather than holding Class A shares, which had a FMV of about $13 million, 276 held Class B shares with the same FMV. Relying on a previous case, Triad Gestco, the court distinguished a “paper loss” from an “economic ” or “true” loss and held that, given the object, spirit and purpose of paragraphs 38(b), 39(1)(b) and 40(1)(b), a paper loss does not give rise to an allowable capital loss. The court noted that the capital gains regime came forth from the Carter Commission’s recommendations: increases in the value of capital assets gives rise to a form of enrichment and should be taxed. In this way, capital gains and capital losses are taxed or deducted only when they are realized. Unrealized capital gains and capital losses are neither taxed nor deducted (unless otherwise specified, for instance deemed realization upon death). The FCA ruled that allowing an unrealized capital loss – i.e., a paper loss – to offset a realized capital gain frustrates the object, purpose, and spirit of the capital gains regime. |