Budget 2015: Expanded the Scope of 55(2)

Tax Avoidance of Corporate Capital Gains (Section 55)

The Income Tax Act contains an anti-avoidance rule that generally taxes as capital gains certain otherwise tax-deductible inter-corporate dividends. This rule typically applies where a corporation that is about to dispose of shares of another corporation receives from that other corporation tax-deductible dividends that in substance reflect the untaxed appreciation in the value of the other corporation. The tax-deductible dividends decrease the fair market value of the shares, or in some cases increase the cost of the shares, to the point where the unrealized capital gain on the shares is reduced.

The anti-avoidance rule generally applies to a dividend where, among other things, one of the purposes of the dividend was to effect a significant reduction in the portion of the capital gain that, but for the dividend, would have been realized on a disposition of any share at its fair market value. Certain exceptions to the application of the anti-avoidance rule are provided. Notably, an exception is provided where the dividend can reasonably be attributed to after-tax earnings (called “safe income on hand”), enabling a corporation to distribute such earnings as a tax-deductible inter-corporate dividend. Another exception allows for dividends received in certain related-party transactions.

Where the anti-avoidance rule applies to the dividend received on a share, the dividend is treated as proceeds of disposition if a corporation has disposed of the share, or as a gain from a disposition of capital property where a corporation has not disposed of the share.

As noted, the anti-avoidance rule currently applies where a dividend significantly reduces the capital gain on any share. However, the same tax policy concern arises where dividends are paid on a share not to reduce a capital gain on that share but instead to cause the fair market value of the share to fall below its cost or a significant increase in the total cost of properties. In that case, the shareholder could attempt to use the unrealized loss created by the payment of the dividend to shelter an accrued capital gain in respect of other property.

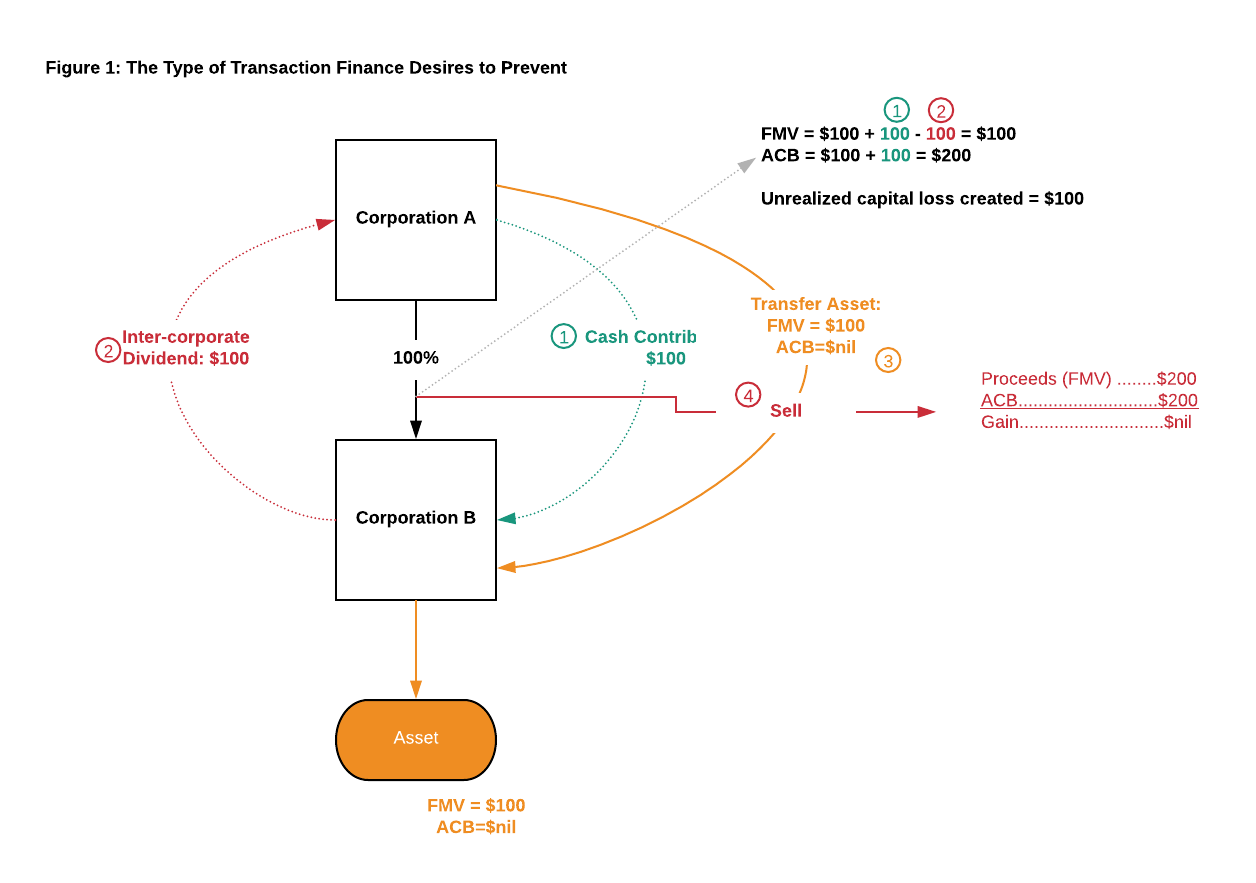

Example: The Sort of Transaction Finance Wants to Prevent

Corporation A wholly owns Corporation B, which has one class of shares. These shares have a fair market value of $1 million and an adjusted cost base of $1 million.

- Corporation A contributes $1 million of cash to Corporation B in return for additional shares of the same class, with the result that Corporation A’s shares of Corporation B have a fair market value of $2 million and an adjusted cost base of $2 million.

- If Corporation B uses its $1 million of cash to pay Corporation A a tax-deductible dividend of $1 million, the fair market value of Corporation A’s shares of Corporation B is reduced to $1 million although their adjusted cost base remains at $2 million. At this point, Corporation A has an unrealized capital loss of $1 million on Corporation B’s shares.

- If Corporation A transfers an asset having a fair market value and unrealized capital gain of $1 million to Corporation B on a tax-deferred basis, Corporation A could then sell its shares of Corporation B for $2 million and take the position that there is no gain because the adjusted cost base of those shares is also $2 million. See Figure 1 for an illustration.

A recent decision of the Tax Court of Canada held that the current anti-avoidance rule did not apply in a case where the effect of a dividend in kind (consisting of shares of another corporation) was to create an unrealized capital loss on shares. The unrealized loss was then used to avoid capital gains tax otherwise payable on the sale of another property. These transactions can have an effect identical to transactions that directly reduce a capital gain. Such transactions may be challenged by the Government under the existing general anti-avoidance rule. However, as any such challenge could be both time-consuming and costly, the Government is introducing specific legislative measures to ensure that the appropriate tax consequences apply.

Budget 2015 proposes an amendment to ensure that the anti-avoidance rule applies where one of the purposes of a dividend is to effect a significant reduction in the fair market value of any share or a significant increase in the total cost of properties of the recipient of the dividend.

Related rules are also proposed to ensure this amendment is not circumvented.

- For example, if a dividend is paid on a share of a corporation, and the value of the share is or becomes nominal, the dividend will be treated as having reduced the fair market value of the share.

- As well, changes will address the use of stock dividends (i.e., dividends that consist of additional shares of the same corporation) as a means of impairing the effectiveness of the anti-avoidance rule.

Budget 2015 proposes an amendment to ensure that any dividend to which the anti‑avoidance rule applies is to be treated as a gain from the disposition of capital property.

Budget 2015 also proposes that the exception for dividends received in certain related-party transactions [55(3)(a) reorganizations] be amended so that the exception will apply only to dividends that are received on shares of the capital stock of a corporation as a result of the corporation having redeemed, acquired or cancelled the shares.

This measure will apply to dividends received by a corporation on or after Budget Day.

April 2016 Notice of Ways and Means Motion

Deemed proceeds or gain

ITA 55(2)

Subsection 55(2) of the Act is an anti-avoidance provision directed against dividends designed to use the intercorporate dividend deduction to unduly reduce the capital gain on any share. When the subsection applies, the amount of the dividend is deemed to be either proceeds of disposition of the share on which the dividend is paid or a capital gain of the corporation that received the dividend, and not to be a dividend received by the corporation. Section 55 is intended to counter the reduction of corporate capital gains on any share through the payment of tax-deductible dividends that reduce the share’s fair market value or that increase the cost of property.

Subsection 55(2) does not apply where the gain that has been reduced is attributable to the share’s portion of the income (“safe income“) earned or realized by any corporation after 1971 and before the safe-income determination time for the transaction, the event or the series of transactions or events in which a corporation resident in Canada has received a dividend deductible under subsections 112(1), 112(2) or 138(6). Safe income is protected from the application of subsection 55(2) because this income has been subject to corporate income tax and should therefore be allowed to be paid as a tax-free dividend to other Canadian corporations.

Prior to Budget 2005, Subsection 55(2) applied where one of the purposes of (or, in the case of a dividend under subsection 84(3), one of the results of) a dividend is to significantly reduce the capital gain on any share.

A recent decision of the Tax Court of Canada held that the current anti-avoidance rule did not apply in a case where the effect of a dividend in kind (consisting of shares of another corporation) was to create an unrealized capital loss on shares (that is, the shares had a cost that exceeded fair market value after the dividend is paid). The unrealized loss was then used to avoid corporate capital gains tax otherwise payable on the sale of another property. These transactions can have an effect identical to transactions that directly reduce a corporate capital gain. Such transactions may be challenged by the Government under the existing general anti-avoidance rule. However, as any such challenge could be both time-consuming and costly, section 55 is being amended to ensure that the appropriate tax consequences apply.

Subsection 55(2) is amended to address the same tax policy concern that can arise where dividends are paid on a share not to reduce a capital gain on the share but instead to cause a significant decrease to the fair market value of the share or to cause a significant increase in the total cost amounts of properties of the corporate dividend recipient. Such dividends can result in an undue reduction of corporate capital gains.

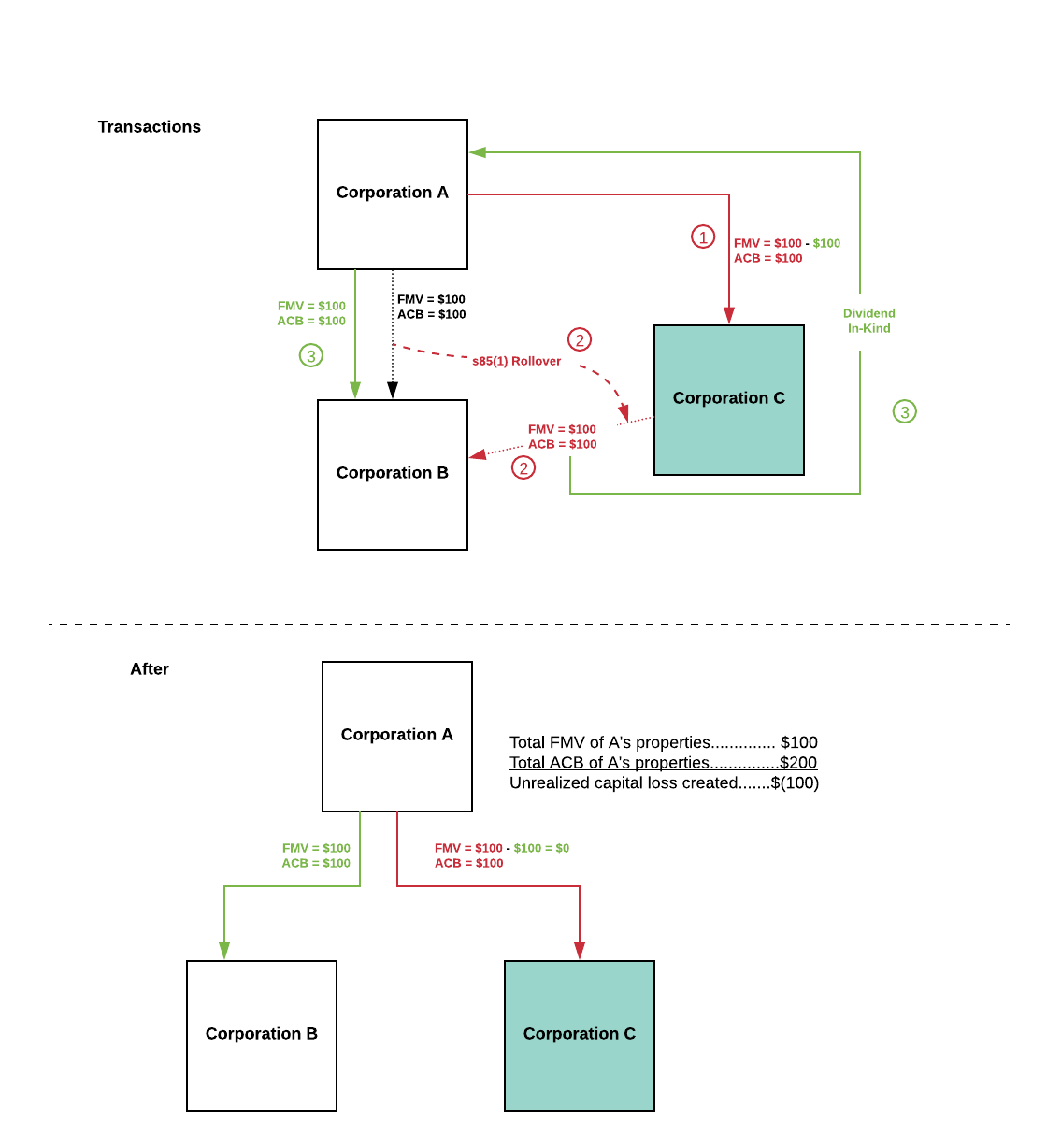

Example: How A Dividend Recipient May Cause a Significant Increase in the Total Cost Amounts of Properties

Corporation A wholly owns Corporation B, which has one class of shares (Class B). These shares have a fair market value (FMV) of $1 million and an adjusted cost base (ACB) of $1 million.

- Corporation A sets up Corporation C which has one class of shares (Class C). These Class C shares have a FMV/ACB= $0.

- Corporation A transfers its Class B shares (FMV/ACB=$1 million) to Corporation C in return for additional Class C shares (FMV/ACB=$1 million).

- Corporation C pays a $1 million dividend in kind to Corporation A – the in kind property is Corporation C’s Class B shares of Corporation B (FMV/ACB=$1 million).

Result:

1. Corporation C has a $0 capital gain from disposing of its Class B shares of Corporation B (FMV/ACB=$1 million).

2. The FMV of Corporation C is reduced by $1 million because of the payment of the $1 million dividend in kind.

3. The FMV of Corporation A’s Class C shares of Corporation C is reduced to $0 from $1 million. Their ACB remains $1 million.

4. The total cost amount of all of Corporation A’s properties is

a. $1 million immediately before the dividend (Class C ACB=$1 million), and

b. $2 million immediately after the dividend (Class C ACB=$1 million + Class B ACB=$1 million).

Figure 2: Diagram of Example Above

Subsection 55(2) is replaced by subsections 55(2) to (2.5).

Amended subsection 55(2) provides that if it applies to a taxable dividend received by a corporation resident in Canada (referred to in subsections (2) to (2.2) and subsection (2.4) as the “dividend recipient”), the amount of the dividend (other than the portion of it, if any, subject to tax under Part IV that is not refunded as a consequence of the payment of a dividend by a corporation where the payment is part of the series referred to in subsection (2.1)) is deemed not to be a dividend received by the dividend recipient (paragraph 55(2)(a)). Instead, the amount of the dividend is deemed to be either:

- proceeds of disposition of the share by paragraph 55(2)(b), if the dividend is received on a redemption, acquisition or cancellation of a share, by the corporation that issued it, to which subsection 84(2) or (3) applies, except to the extent that it is otherwise included in computing such proceeds; and

- a gain of the dividend recipient, for the year in which the dividend was received, from the disposition of capital property by paragraph 55(2)(c), in the case of any dividend that is not subject to the application of paragraph (b).

In the case of the exception from subsection 55(2) accorded the portion of a dividend to which Part IV tax applies, this exception does not apply if a refund of Part IV tax is received as part of a series as a consequence of the payment of a taxable dividend by a corporation to any shareholder, including an individual.

This amendment applies to dividends received after April 20, 2015.

Application of subsection 55(2)

ITA 55(2.1)

New subsection 55(2.1) of the Act determines if subsection 55(2) applies to a taxable dividend received by a corporation resident in Canada (referred to in subsections (2) to (2.2) and subsection (2.4) as the “dividend recipient”) as part of a transaction or event or a series of transactions or events. Subsection 55(2) applies to a dividend recipient’s taxable dividend if the three conditions in paragraphs 55(2.1)(a) to (c) are met.

First, the condition in paragraph (a) is met where the dividend recipient is entitled to a deduction in respect of the taxable dividend under subsection 112(1) or (2) or 138(6).

Second, the condition in paragraph (b) is met where

(i) one of the purposes of the payment or receipt of the dividend (or, in the case of a dividend under subsection 84(3), one of the results of which) is to effect a significant reduction in the portion of the capital gain that, but for the dividend, would have been realized on a disposition at fair market value of any share of capital stock immediately before the dividend, or

(ii) the dividend (other than a dividend received in respect of a redemption, acquisition or cancellation of a share, by the corporation that issued it, to which subsection 84(2) or (3) applies) is received on a share that is held as capital property by the dividend recipient and one of the purposes of the payment or receipt of the dividend is to effect

- a significant reduction in the fair market value of any share, or

- a significant increase in the amount that is the total of the cost amounts of all properties of the dividend recipient.

The “one of the purpose” tests in subparagraphs (b)(i) and (ii) are to be applied separately to each dividend.

- For example, subparagraph (b)(ii) could apply to a dividend one of the purposes of which is to increase significantly the cost of any property even if subparagraph (i) applies (or does not apply because one of the purposes was not to reduce significantly a gain on any share).

- Subparagraph (b)(ii) does not apply, however, to a dividend received on the redemption, acquisition or cancellation of a share by the corporation that issued it, to which subsection 84(2) or (3) applies. In such cases, the shares are disposed of to the issuing corporation.

Third, the condition in paragraph (c) is met where the amount of the dividend exceeds the amount of safe income that could reasonably be considered to contribute to the capital gain that could be realized on a disposition at fair market value, immediately before the dividend, of the share on which the dividend is received. Former subsection 55(2) referred to the safe income exception by referring to the portion of the capital gain “attributable” to safe income. Paragraph (2.1)(c) instead refers to the portion of the safe income that could reasonably be considered to “contribute” to the capital gain that could be realized. This change of wording is intended to accommodate the new purposes described in subparagraph (b)(ii).

This amendment applies to dividends received after April 20, 2015.

Special rule – the amount of the stock dividend

ITA 55(2.2)

New subsection 55(2.2) of the Act sets out the amount of a stock dividend for the purpose of applying subsections (2), (2.1), (2.3) and (2.4). For this purpose, the amount of a stock dividend and the dividend recipient’s entitlement to a deduction under subsection 112(1) or (2) or 138(6) in respect of that dividend is the greater of

(1) the increase in the paid-up capital of the corporation that paid the dividend because of the dividend, and

(2) the fair market value of the share received as a stock dividend.

Example

Assume that Corporation A pays a stock dividend to Corporation B and that the share that is issued as a stock dividend has a fair market value (FMV) of $1 million and a paid-up capital (PUC) of $1.

The amount of the stock dividend to Corporation B is $1 million for the purpose of applying subsections 55 (2), (2.1), (2.3) and (2.4). Under subsection 55(2.2), the amount of the stock dividend is the greater of

- $1 (PUC of $1, which would otherwise be the amount of the stock dividend under the definition “amount” in subsection 248(1)), and

- $1 million (the FMV of the share issued as a stock dividend).

As a result, the “one of the purposes” tests in subparagraph 55(2.1)(b)(i) and (ii) are to be applied to a $1 million dividend instead of the $1 dividend determined under the definition of “amount” in subsection 248(1).

For further information, see commentary on subsection 52(3).

This amendment applies to dividends received after April 20, 2015.

Stock dividends and safe income

ITA 55(2.3)

New subsection 55(2.3) of the Act applies if the conditions in new subsection 55(2.4) are met. In general terms, new subsection 55(2.3) applies to a stock dividend if the fair market value of the share that is issued as a stock dividend exceeds the amount of the related increase in the paid-up capital of the corporation that paid the dividend, to the extent that the dividend would have been subject to subsection 55(2) if the exception regarding income earned or realized by any corporation after 1971 and before the safe-income determination time (“safe income”) did not exist.

Subsection 55(2.3) provides two rules regarding the amount of a stock dividend and safe income.

- First, paragraph 55(2.3)(a) provides in general that the amount of a stock dividend is deemed to be a separate taxable dividend for the purpose of applying subsection 55(2) to the extent of the portion of the amount that does not exceed the safe income that could reasonably be considered to contribute to the capital gain that could be realized on a disposition at fair market value, immediately before the dividend, of the share on which the dividend is received. The effect of this provision is analogous to that provided to dividends received out of a corporation’s safe income under amended paragraph 55(5)(f). The portion of the stock dividend that exceeds the amount of safe income, if any, can be subject to subsection 55(2).

- Second, paragraph 55(2.3)(b) provides in general that the separate dividend out of safe income to which paragraph (a) applies is deemed to reduce the safe income of any corporation that could reasonably be considered to contribute to the capital gain that could be realized on a disposition at fair market value, immediately before the dividend, of the share on which the dividend is received.

This amendment applies to dividends received after April 20, 2015.

Application of subsection 55(2.3)

ITA 55(2.4)

New subsection 55(2.4) of the Act provides that new subsection (2.3) applies if the conditions indicated in paragraphs (a) to (c) are met.

First, the condition in paragraph (a) is met where a corporation resident in Canada (referred to in subsections (2) to (2.2) and subsection (2.4) as the “dividend recipient”) holds a share upon which it receives a stock dividend.

Second, the condition in paragraph (b) is met where the fair market value of the share or shares issued as a stock dividend exceeds the amount by which the paid-up capital of the corporation that paid the stock dividend is increased because of the dividend.

Third, the condition in paragraph (c) is met where subsection 55(2) would apply to the dividend if subsection (2.1) were read without reference to its paragraph (c). In general, paragraph 55(2.1)(c) applies where the amount of a dividend exceeds the safe income that could reasonably be considered to contribute to the capital gain of the share on which the dividend is received.

As result, if one of the purposes of the payment or receipt of a stock dividend is to significantly reduce a capital gain on any share, to significantly reduce the fair market value of any share or to significantly increase the total of all cost amounts of all properties of the dividend recipient, the amount of the dividend (which is the greater of its fair market value and its paid up capital for the purpose of section 55) can be either

- a taxable dividend paid out of safe income (to the extent that subsection (2.3) applies), or

- a taxable dividend to which subsection (2) applies (except to the extent that the Part IV exception applies to the dividend, or if the exemptions in subsection 55(3) apply).

This amendment applies to dividends received after April 20, 2015.

Determination of reduction in fair market value

ITA 55(2.5)

New subsection 55(2.5) of the Act provides that, for the purpose of applying the fair market value (FMV) reduction rule in clause 55(2.1)(b)(ii)(A), whether any dividend causes a significant reduction in the fair market value of any share is to be determined as if the fair market value of the share, immediately before the dividend, was increased by an amount equal to the amount, if any, by which the fair market value of the dividend received on the share exceeds the fair market value of the share.

Example

Corporation A owns all of the shares of Corporation B, which have a total fair market value (FMV) of $0.

Corporation B borrows $2 million to pay a $2 million dividend to Corporation A. The FMV of the shares of Corporation B remains at $0 after the payment of the $2 million dividend. Therefore, the dividend has not reduced the FMV of the shares of Corporation B.

The FMV of the dividend ($2 million) exceeds the FMV of the shares ($0) by $2 million.

Subsection 55(2.2) requires that the FMV of the shares of Corporation B be increased by $2 million before the dividend (the amount by which the FMV of the dividend exceeds the FMV of the share on which the dividend was paid). Consequently, the reduction in the FMV of the shares caused by the dividend is considered to be $2 million (as opposed to no FMV reduction without the rule).

This amendment applies to dividends received after April 20, 2015.

Exemption from subsection 55(2)

ITA 55(3)(a)

Paragraph 55(3)(a) of the Act provides an exemption from the application of subsection 55(2) for dividends received in the course of certain related-party transactions. More specifically, paragraph (a) exempts a dividend received by a corporation if, as part of a transaction or event or a series of transactions or events that includes the receipt of the dividend, there was not, at any particular time, a disposition of property or a significant increase in the total direct interest in a corporation in the circumstances described in subparagraphs (a)(i) to (v).

The exemption for dividends in paragraph (a) is amended to apply only to dividends received on a redemption, acquisition or cancellation of a share, by the corporation that issued it, to which subsection 84(2) or (3) applies. In both cases, the dividend arises on a cancellation of the share. This change is made consequential to amendments to subsection 55(2) and new subsections 55(2.1) to (2.5). It is meant to ensure that subsections 55(2) to (2.5) are not circumvented by related persons using other types of dividends to significantly reduce a capital gain in respect of any share, to significantly reduce the fair market value of any share or to significantly increase the total of the cost amounts of all of the properties of the dividend recipient.

The amended exception in paragraph (a) for related-person dividends is intended to facilitate bona fide corporate reorganizations by related persons. It is not intended to be used to accommodate the payment or receipt of dividends or transactions or events that seek to increase, manipulate, manufacture or stream cost base.

This amendment applies to dividends received after April 20, 2015.